Unique Info About How To Get A Vat Number

We will get you a vat number for your amazon business in any eu country.

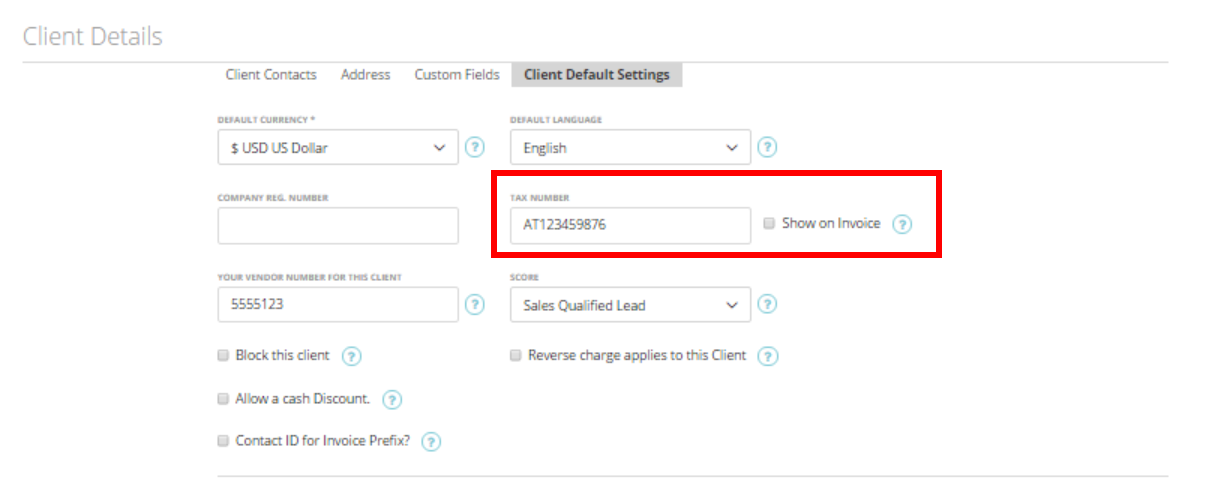

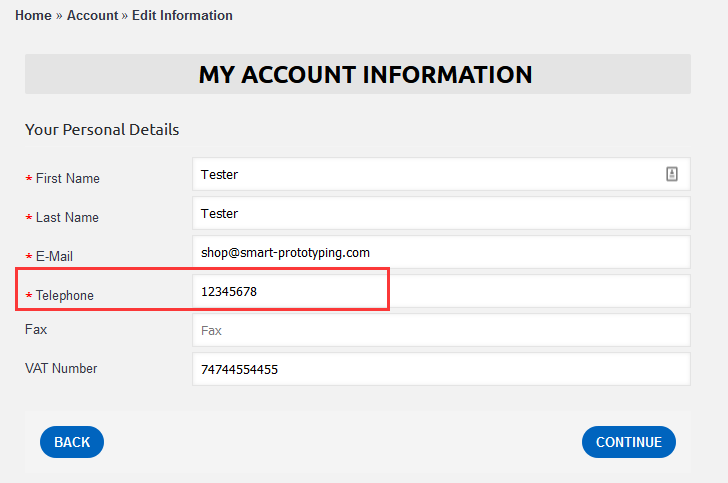

How to get a vat number. Who may to register for vat? When you receive your vat number from hmrc, you can sign up for a vat online account (select option ‘ vat submit returns’). Learn more about vat invoices and when you need to issue them.

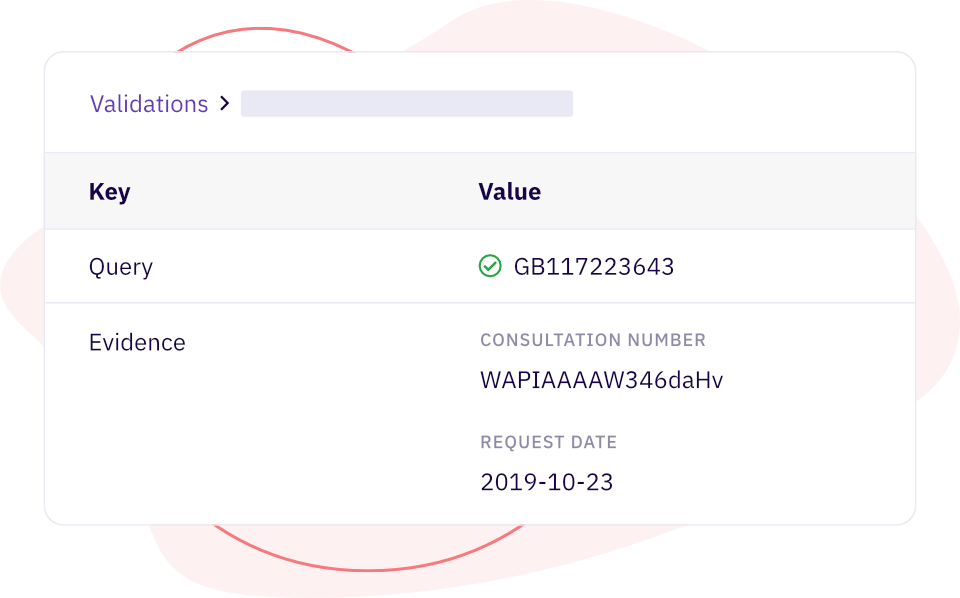

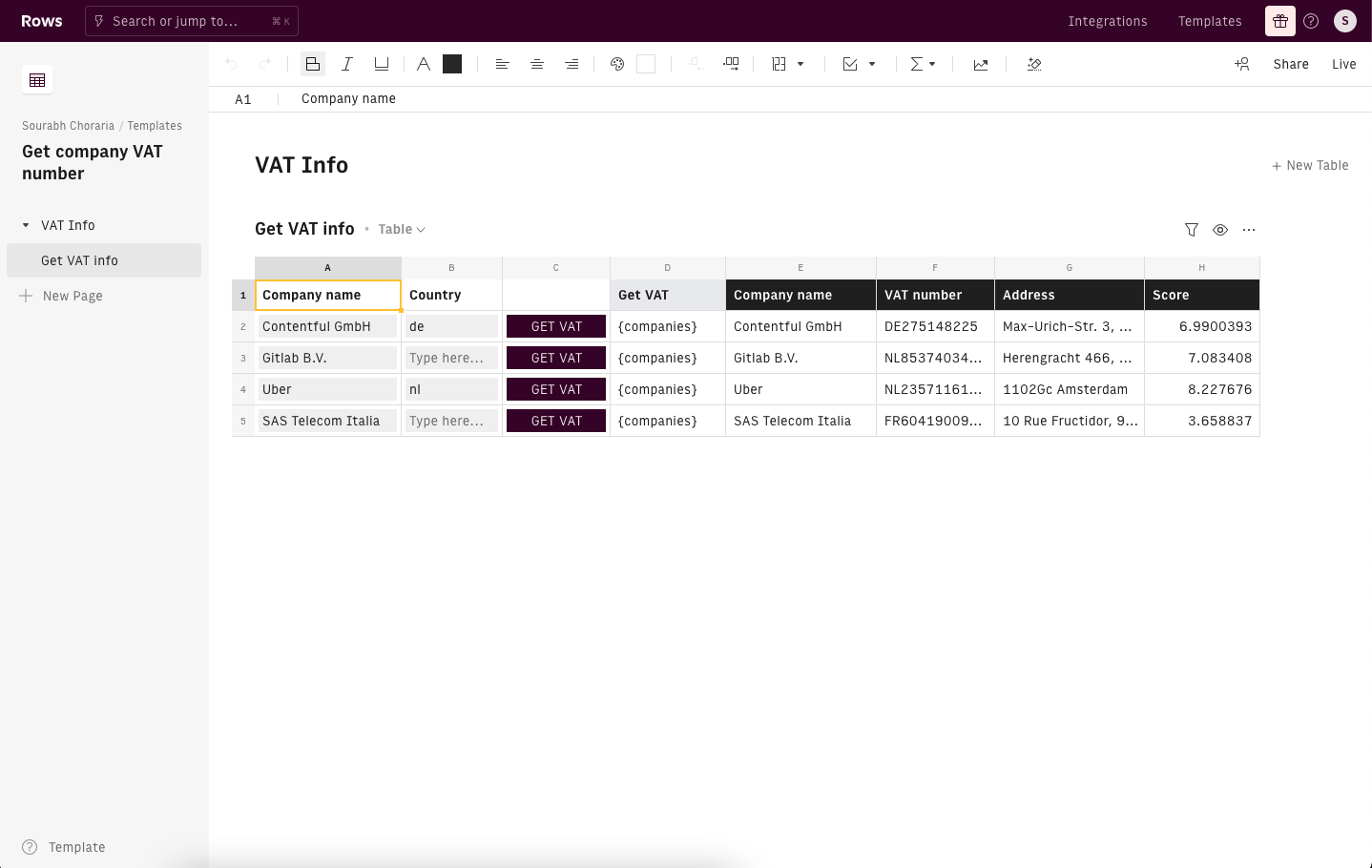

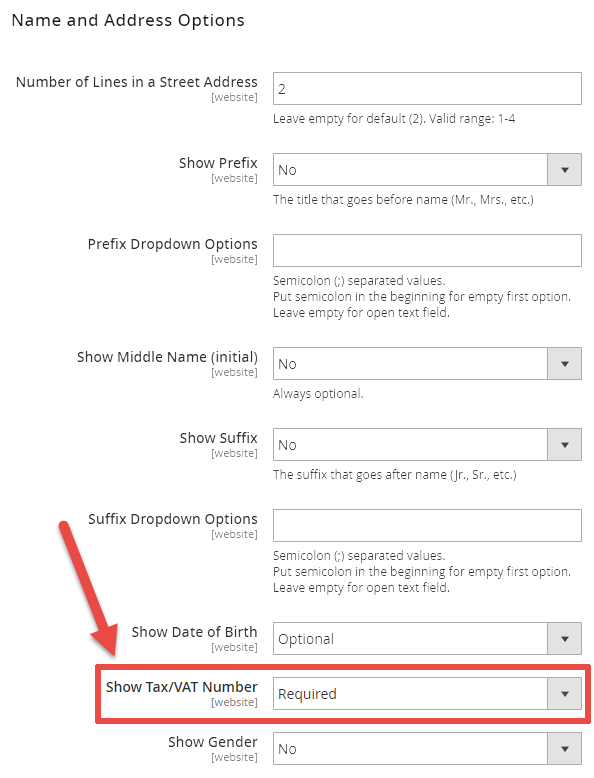

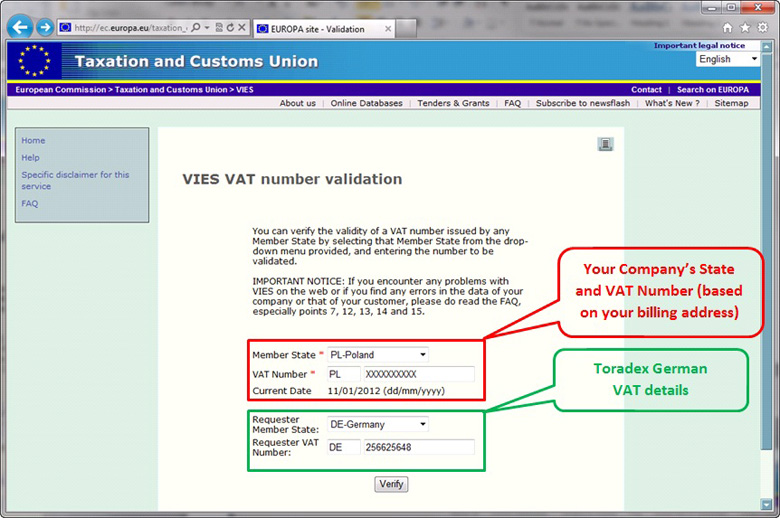

Registration may be voluntary if the business is under the vat threshold, or. 1) apply for a tax identification number (tin) in your country of residence by submitting documentation and waiting for. By entering the registration numbers and relevant country codes into the fields provided, you can check if a supplier’s vat number is valid.

Starting at $75 or €81.25. +44 (0)20 7299 1453 if a business makes any kind of taxable supply, it can register for vat. Now that we have a more detailed understanding of why a vat number is so important from a business and regulatory perspective, we should clarify how to get a vat registration number.

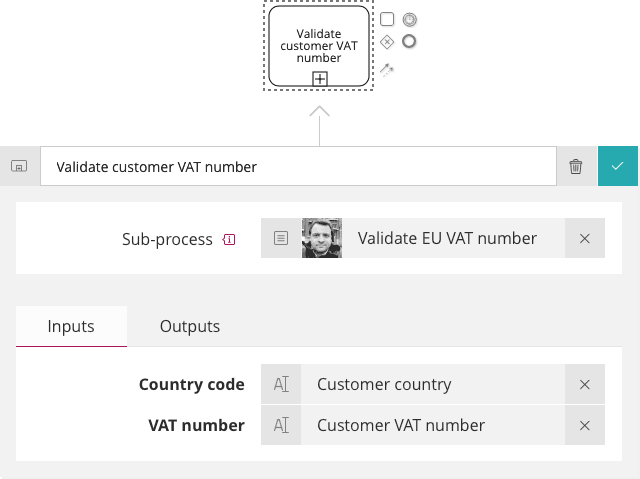

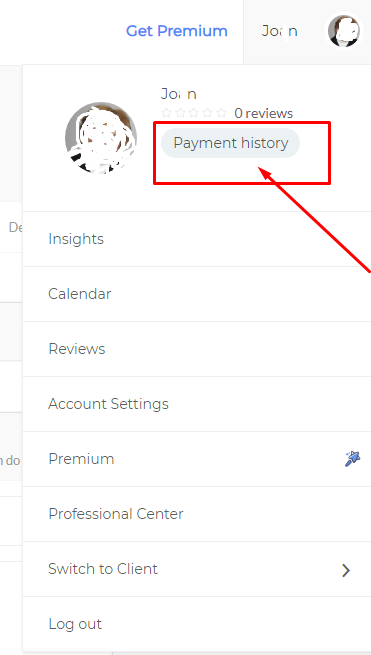

The vat number can either be applied for online at the respective tax office, by mail or, and this is probably the easiest way, directly in the hellotax tax software. Determine whether you are registering as an individual, an agent, or an organization that is established in the state of application. You can apply for a registration ‘exception’ if your taxable turnover goes over the threshold temporarily.

The written application for the vat identification number must be sent to: Bundeszentralamt für steuern, dienstsitz saarlouis, 66738 saarlouis, telefax: The vat number is referred to with different names, but.

There are two ways to obtain a vat number: You will need to create a vat online account, which is often referred to as a “government gateway account”. After you’ve registered you’ll get:

The most important indirect tax is the value added tax (vat), however, in canada, it is known as the. The vat number in germany is used to identify you when making payments to the vat department in germany (finanzamt). Up to 7% cash back eu vat regustration any country.

The canadian taxation system is made of direct and indirect taxes. Write to hmrc with evidence showing why you believe your vat taxable turnover. If the supplier’s vat registration is shown as invalid.

The rfc number is documented with the mexico tax bureau. Follow the easy steps to register for vat on efiling make a virtual appointment via our ebooking system. If the business you’re dealing with is vat registered, you can easily find its.

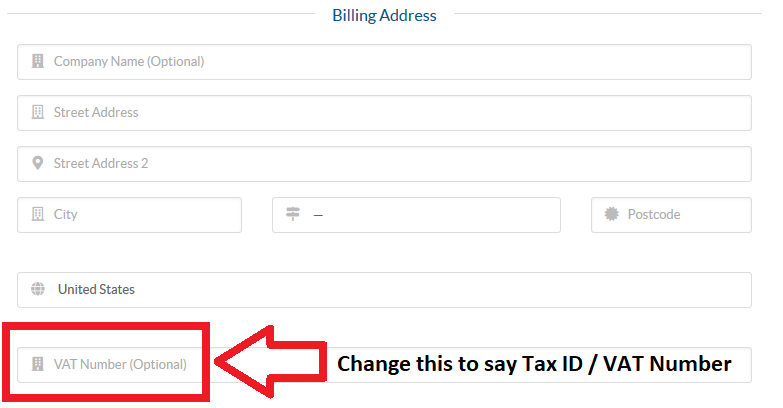

The easiest way to get a uk vat number is to apply online on hmrc’s website. Steps to apply for a vat account online 1. In order to submit an application for registration and get a vat number, you can go directly to the official website of the administration authority of the relevant country or ask for a tax.

:filters:format(jpeg)/f/88751/3162x1704/8f7196b400/vat.png)