Painstaking Lessons Of Tips About How To Increase Government Revenue

Further, their use will allow current employees to tackle the.

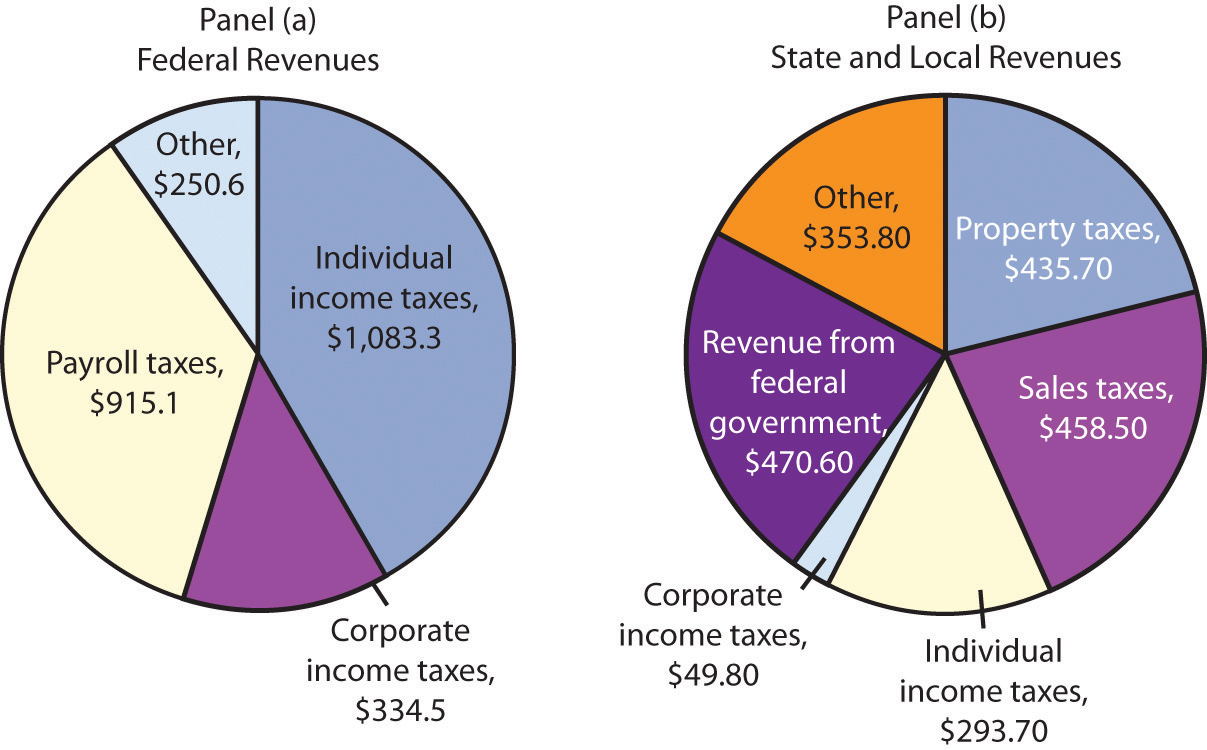

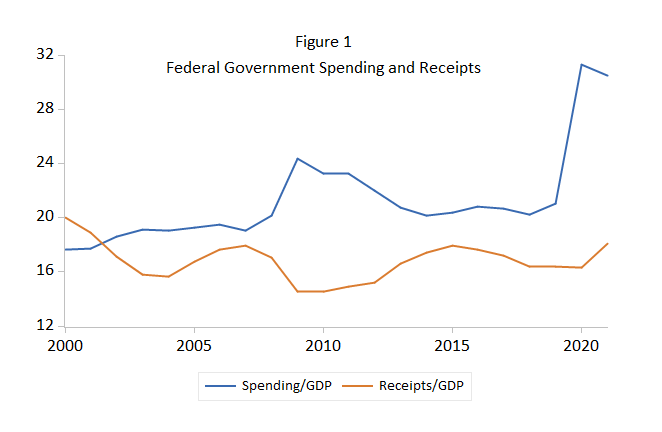

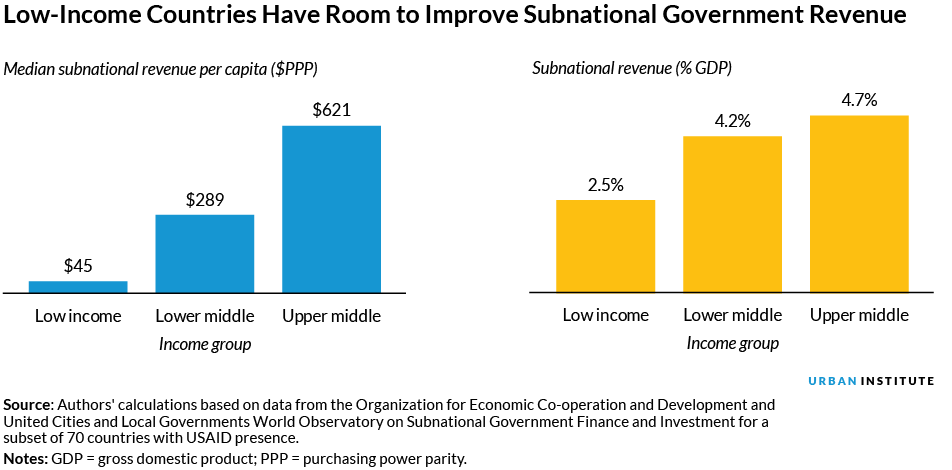

How to increase government revenue. By a question of business. The federal government has said it will increase its revenue to 15 per cent of gross domestic product by 2025. Here’s 3 ideas on how state and local governments can increase revenue:

10 ways for the government to raise revenue. Government wants to increase domestic revenue through taxation but at the same time faces threat of increased poverty. By using kiosks and contactless payment solutions, governments can save money on labor and bolster revenues.

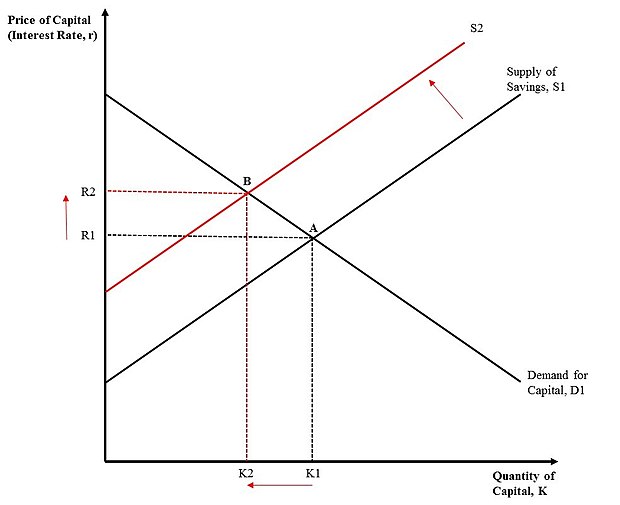

Refine your pricing plan in most cases, increasing price is an effective way to boost revenue, assuming demand remains the same. Increase taxpayers’ voluntary compliance with tax laws through outreach and education to increase collection and address informality. By adopting the streamlined sales tax and other reforms that make sales tax systems more uniform across states.

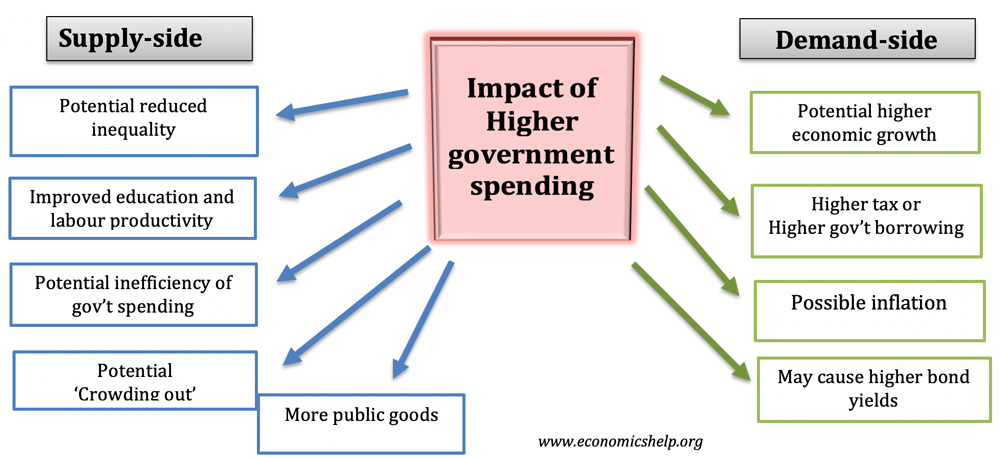

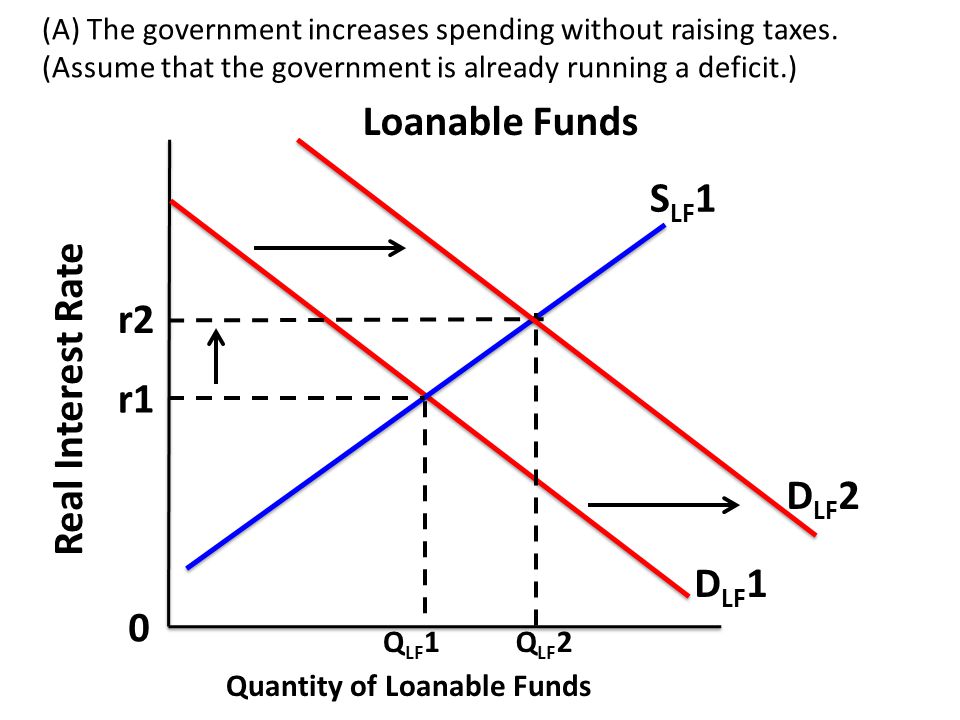

In our experience, governments can capture significant value—up to 50 percent of potential additional revenues—by implementing measures linked to effectiveness such as. As salaried employees prepare to. Progressive ideas to raise more revenue, reduce tax avoidance, and reduce the tax gap 1.

The current top rate on earned income is about 40 percent for. They must hold regular meetings with the public and explain. To raise revenue in a progressive, efficient, and administrable manner, this chapter proposes a new national consumption tax:

Make quantifiable goals for how much you want to increase your sales and revenue. How to increase revenues and sales. An increase in the consumption of kassippu.

With high unemployment rate and a poor population it. To increase local government revenue, district assembly officials must engage the local people in honest discourse. You must start with a clear strategy that is aligned with your revenue goals.

But it will help our state government to balance the budget as well. You need to identify what. Thus resulting in increase revenue.

Increasing the number of income earners with a college degree could poten ally increase state tax revenues by $37. Reduction in excise revenue from the sale of legal liquor.

:max_bytes(150000):strip_icc()/LafferCurve2-3509f81755554440855b5e48c182593e.png)